Stop saying yes to the “less bad” renewal.

Take control of your health insurance with Health ReLeaf.

It’s time to take control. Healthcare costs and health insurance premiums have spiraled out of control for long enough. Gone are the days of rich benefits plans and affordable premium contributions, and instead, those have been replaced with high deductibles and unaffordable family premium contributions. Our team of experts has designed a plan – that’s non-disruptive for you and your employees – but allows your broker to get your costs under control and provide the relief that is so desperately needed.

Here’s How it Works

You can’t manage what you don’t track, so we begin the process with a risk assessment. The data collected by this risk assessment allows our team members to develop a deep understanding of your employee demographics, the care they consume, and the care that they need.

You can’t manage what you don’t track, so we begin the process with a risk assessment. The data collected by this risk assessment allows our team members to develop a deep understanding of your employee demographics, the care they consume, and the care that they need.

Our team will then curate a program based on the unique needs of your employee population. The resulting health plan will address the needs of the individual employees (especially those in their time of need) and the claims that are driving the healthcare spending.

Our team will then curate a program based on the unique needs of your employee population. The resulting health plan will address the needs of the individual employees (especially those in their time of need) and the claims that are driving the healthcare spending.

One of the unique components of ReLeaf Health Plan is the insurance, known as “reinsurance.” This is set up to protect you from unknown risks and allow you to pay a guaranteed monthly premium – as easy as being fully insured.

One of the unique components of ReLeaf Health Plan is the insurance, known as “reinsurance.” This is set up to protect you from unknown risks and allow you to pay a guaranteed monthly premium – as easy as being fully insured.

The ReLeaf team will then manage the transition process, the open enrollment process, and the employee communication process. This will ensure a smooth rollout of your new program.

The ReLeaf team will then manage the transition process, the open enrollment process, and the employee communication process. This will ensure a smooth rollout of your new program.

Throughout the plan year, the ReLeaf team will closely monitor claims and healthcare utilization for your plan. If there are employees that need help, questionable charges, or cost containment opportunities, the ReLeaf team will take immediate action.

Throughout the plan year, the ReLeaf team will closely monitor claims and healthcare utilization for your plan. If there are employees that need help, questionable charges, or cost containment opportunities, the ReLeaf team will take immediate action.

One of the best parts about this program? Every reduction in healthcare costs impacts you immediately and directly. Every dollar managed is a dollar saved.

One of the best parts about this program? Every reduction in healthcare costs impacts you immediately and directly. Every dollar managed is a dollar saved.

You in Control; That’s Different

Funding The Known Risks & Insuring The Unknown

By identifying the Known Risks, we can help NCRMA Company Members save up to 20% within the first year.

Product Perks:

Preferred pricing by joining with other businesses to share risks

Employee health assessment to identify known risks

Made specifically for companies working in the cannabis industry

Full protection from all volatile claims

Our brokers work as your risk manager to identify:

Claim Reductions, Reductions in High-Cost Specialty Drugs, Fraud, Waste and Abuse Prevention, Areas to Promote General Wellness, and Primary Care Utilization

Requirements:

- Be an Active Company Member of the NCRMA (Don’t worry if you’re not already, you can check if you qualify before becoming a member)

- Seeking coverage for W-2 Employees

Service Perks:

- HIPAA-compliant employee assessment process

- 45-60 days roll out from the first conversation*

- Employee centric advocacy and concierge program

- We handle all aspects of the plan, including financial, actuarial, compliance, program, underwriting, and risk management

*Pre-qualification required

Use Case

Traditional Plan:

Annual costs 1.2 million, you pay 1.2 million

Example Of Our Plan:

Annual costs identified 1.2 million as the

worst-case, but you may only pay $800,000

The Situation

A company in the Northeast had been offering a fully insured medical and prescription drug program for over 50 years. During that time, they tried to find a balance between price and competitive plan design options.

In the midst of a worldwide pandemic, the company received a 190% renewal increase from their insurance carrier. Absolutely shocked to receive such an increase, they asked their broker to conduct a market survey and contact DOBI.

Not surprisingly, the market was hesitant to provide a quote to an employer receiving such a large increase. The broker contacted Health ReLeaf to see if there was an alternative approach to handling this employer’s health plan. The fully insured carrier was unwilling to provide any de-identified claims information, so the broker partnered with Health ReLeaf to promulgate an Individual Medical Questionnaire process to better understand the employer’s risk profile.

190%

Initial fully-insured renewal from carrier

2 Claimants

Identified 2 high-cost claimants

12%

Health ReLeaf’s risk control brought the group’s renewal to 12%

Allow the broker to have more control over the health plan to continue balancing plan costs with design changes.

Broker:

Obtain the ability to better manage high-cost claimants to avoid significant increases in the future.

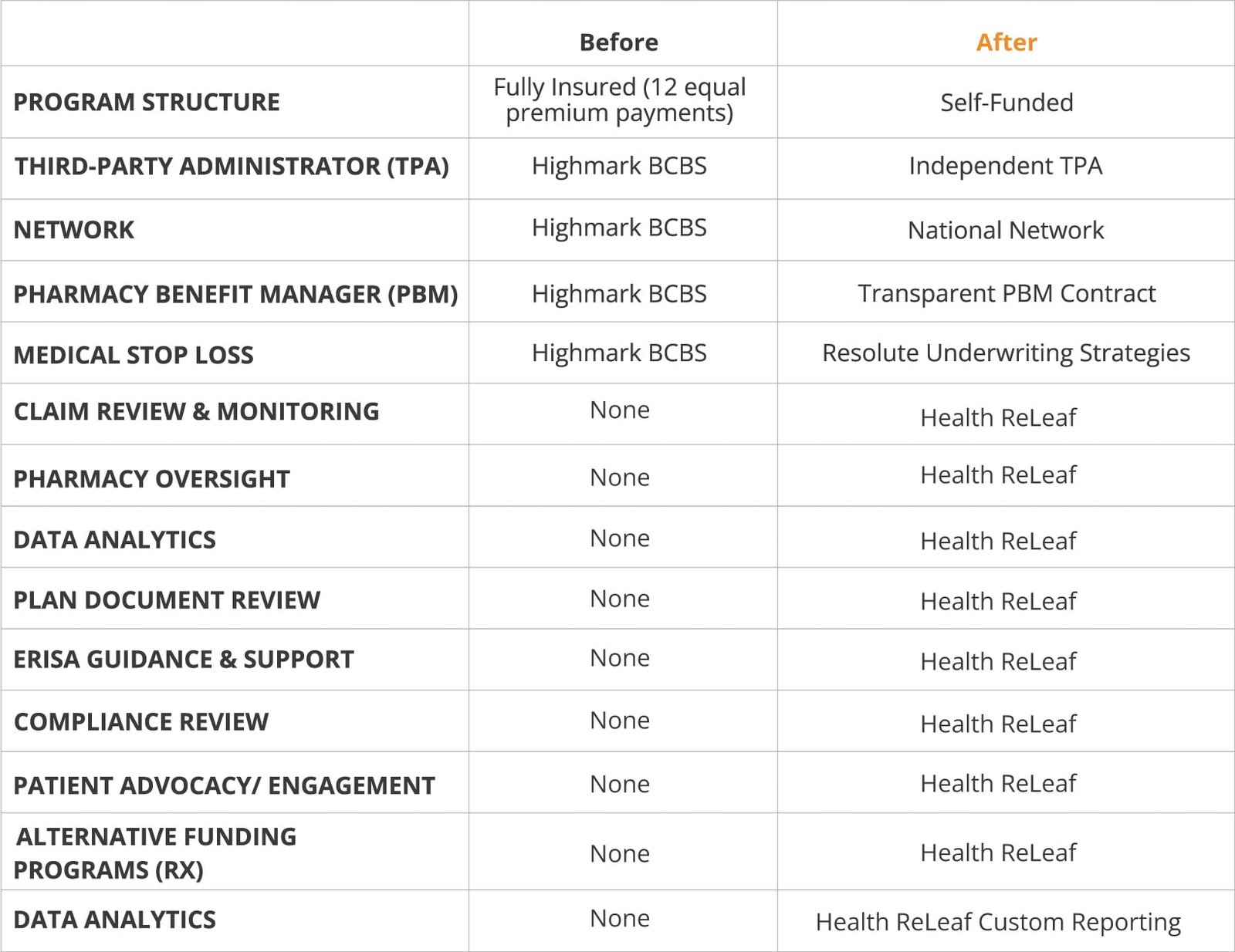

THE CLIENT HAD MANY ISSUES WITH THEIR PRIOR FULLY INSURED HIGHMARK BBS PLAN.

|

|